How To Check if Your House is in a Flood Zone In Florida

See How We're Different

or call us: 954-233-0733

A flood map is a representation of areas that have a high risk of flooding. These maps are created by the Federal Emergency Management Agency (FEMA) and are used to determine flood insurance rates and to help communities plan for and respond to floods.

They typically show the boundaries of Special Flood Hazard Areas (SFHAs), which are areas that have a 1% or greater chance of flooding in any given year. The maps are also used to determine if a property is in a flood zone and if the property owner is required to purchase flood insurance.

It's important to note that flood maps can change over time as new data and development information becomes available. It's essential to check your flood map status regularly to ensure you have the right coverage and you are not paying more than you need to.

What is a Flood Map?

A flood map is a representation of areas that have a high risk of flooding. These maps are created by the Federal Emergency Management Agency (FEMA) and are used to determine flood insurance rates and to help communities plan for and respond to floods.

They typically show the boundaries of Special Flood Hazard Areas (SFHAs), which are areas that have a 1% or greater chance of flooding in any given year. The maps are also used to determine if a property is in a flood zone and if the property owner is required to purchase flood insurance.

It's important to note that flood maps can change over time as new data and development information becomes available. It's essential to check your flood map status regularly to ensure you have the right coverage and you are not paying more than you need to.

Why Should You Check If You're Home or Property is Flood Zone?

Checking your flood zone is important because it helps you determine your level of risk for flooding. Knowing your flood zone can also help you determine if you are required to purchase flood insurance. It also helps you understand the potential damage and costs associated with flooding.

Additionally, checking your flood zone can help you make informed decisions about purchasing or renting a property. If your property is in a flood zone, you may be eligible for a lower rate on your flood insurance premium.

It's important to check your flood zone regularly as the maps are updated and can change over time. This will ensure you have the right coverage and you are not paying more than you need to.

Flood Zone Maps in Florida

Determining if your property is located in a flood zone is easy and cost-free.

The government offers online flood maps for property owners to review. These maps show which areas are prone to flooding at different water levels.

They assist homeowners and decision makers in managing assets, planning cities and managing flood risks.

Find Out If Your Florida Home Is In A Flood Zone Using FEMA

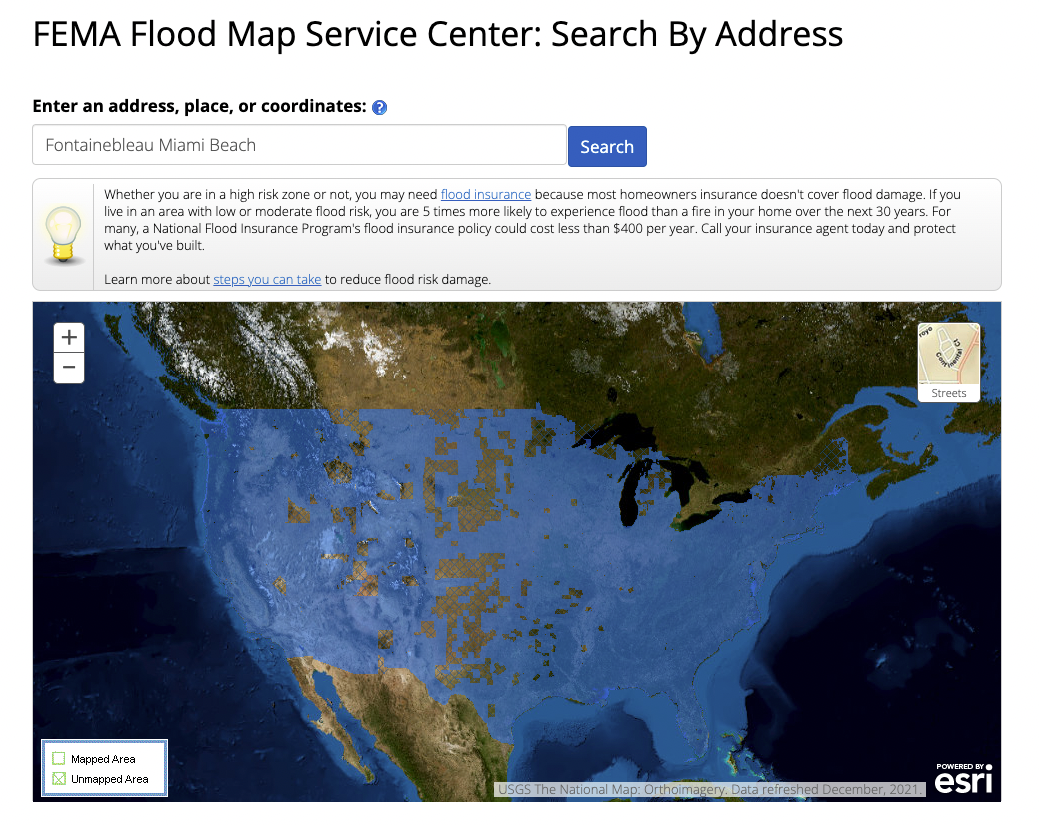

To check if your property is located in a flood zone, search for the address on FEMA.gov.

The following page will provide you access to the nearest and most relevant flood map, which you can export as a PDF.

If the property is a vacant lot without a registered address, search for the nearest property that does have an address.

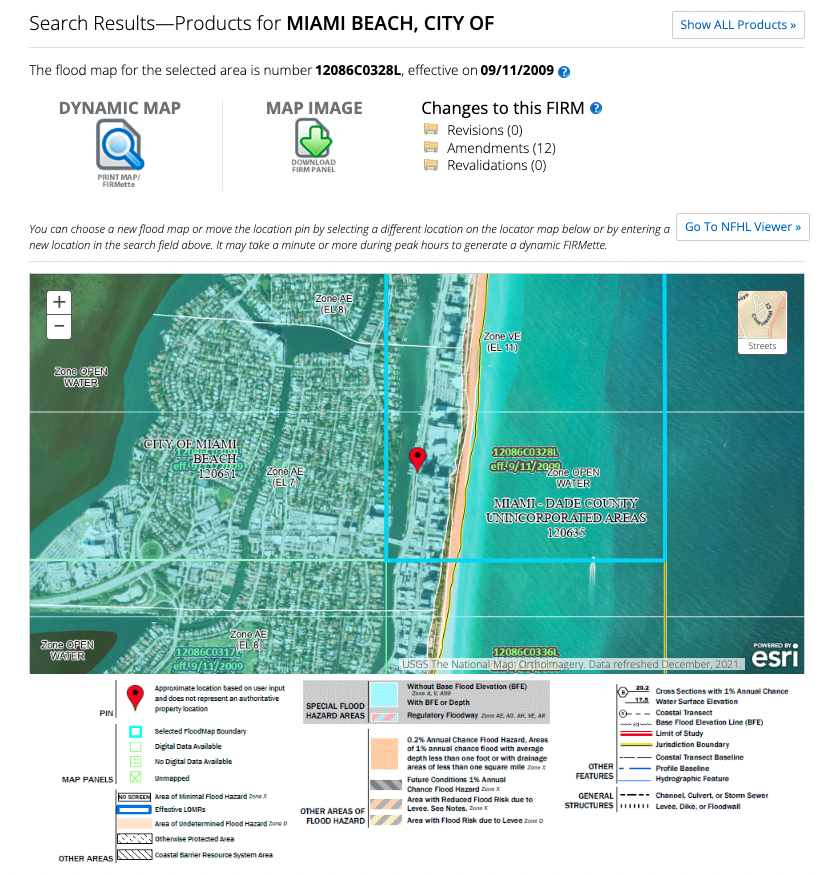

For the example above, this property is located in Flood Zone VE. This is the Federal Emergency Management Agency (FEMA) designation for high-risk coastal communities. It is a Special Flood Hazard Area (SFHA), which means homeowners in this flood zone usually need flood insurance in Florida.

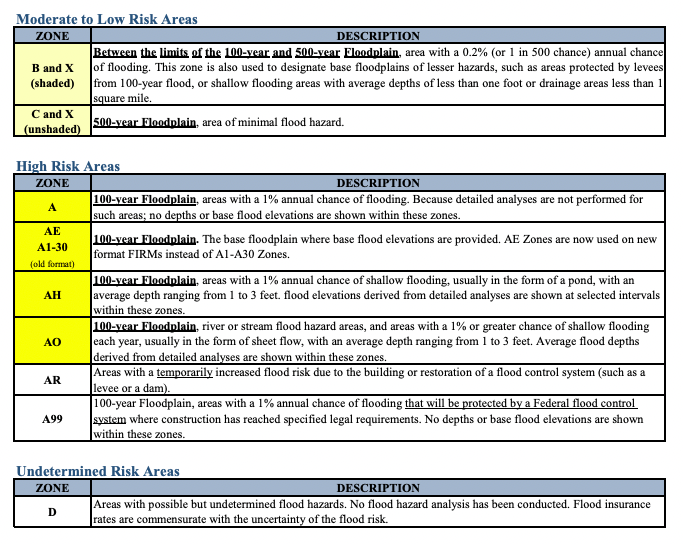

The following chart will help you figure out which Flood zone your propety may be in:

What if I’m in a Flood Zone?!

If you suspect your property is located in a flood zone, particularly a high-risk flood zone, the first step is to reach out to a knowledgeable insurance professional.

They can confirm the accuracy of your assumption and determine the extent of the issue, if any. Additionally, they will be able to provide you with an estimate of the cost to insure your property against the potential damage from a flood.